Polish flag on international waters: national symbol, untapped potential, and future challenges

The Polish flag, once proudly flown on the masts of ships traversing global maritime routes, is now increasingly rare on the waters. In an era of globalization and the dynamic growth of the maritime economy, is our country capable of rebuilding its position at sea? Can we afford to forget the power that comes with a presence on international waters? Or are the Polish merchant fleet and national symbols now merely relics of the past? Together with Captain Tadeusz Hatalski, we have examined the opportunities, challenges, and neglect shaping the future of the Polish flag.

maritime economy opinions and comments ports commentary news13 january 2025 | 07:07 | Source: Gazeta Morska | Prepared by: Kamil Kusier | Print

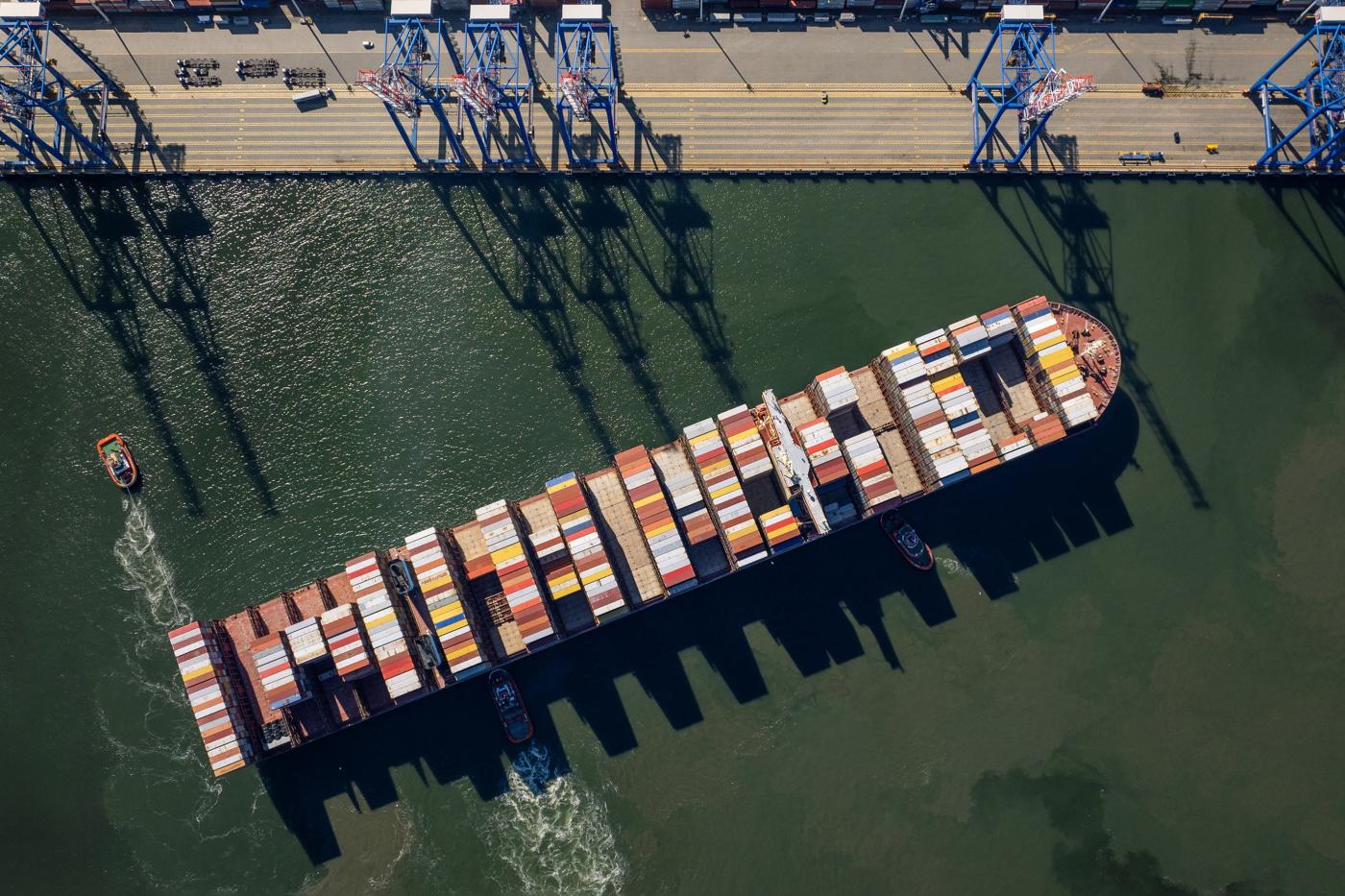

fot. Tomasz Dresler / Port Gdańsk

The revival of the Polish flag remains a topic that stirs emotions among sailors, economists, and politicians. Decades of neglect, a lack of cohesive strategy, and unfavorable legal regulations have gradually caused the Polish merchant fleet to be replaced by ships flying foreign flags. However, modern maritime realities call for a fresh perspective on the potential hidden within the maritime economy.

Poland, with its access to the Baltic Sea, developed port infrastructure, and skilled maritime workforce, has the opportunity to reestablish itself as a maritime power. The key to success lies not only in government support but also in collaboration with international partners and investments in innovations that enable competition with the market's leading players.

How does the current position of the Polish flag fit into the international shipping market?

- Over the past 35 years, since the political transformation, the number of merchant ships, including those registered under the Polish flag, has systematically decreased. In 1989, Poland had a merchant fleet of around 500 vessels, but by 2023, this number had dropped to 88, with only 14 flying the Polish flag (Central Statistical Office data). This decline is primarily due to outdated regulations that, despite the market economy established in 1989, have not been modernized from the centrally planned economic model. The issue of flagging out ships to "convenient flags" is not unique to Poland; it has affected all European nations. However, the European Union has been taking steps for years to reverse this trend. Poland, despite being an EU member, has not adopted measures to create competitive conditions for shipowners as outlined in the 2004 EU Guidelines. This discourages shipowners from registering their vessels in Poland, as the registration procedures are complex, and operating under the Polish flag is economically unviable - explains Captain Tadeusz Hatalski.

The ship registration market is highly competitive, particularly due to the registries of so-called "flags of convenience" countries, which offer simplified registration procedures and favorable operating conditions. EU countries such as Cyprus, Malta, and recently Portugal have created favorable conditions for shipowners, allowing quick and cost-effective registration processes and regulatory frameworks that ensure economic viability.

Captain Hatalski points out that Poland, due to its geographical position on the Baltic Sea, holds significant potential in the regional market, particularly in the Baltic Sea area. However, this potential is limited by the relatively small fleet compared to the dominant players in the region.

Polish shipowners often register their ships under convenient (economic) flags to minimize operational costs and simplify administrative procedures. Examples include Maltese and Cypriot registries, which, as mentioned earlier, offer advantageous registration processes and operating conditions, adds Captain Hatalski.

Regarding the deep-sea fleet, Poland's contribution remains disproportionately small compared to its economic potential. This leads to reliance on other countries for transporting goods in international markets. For instance, Germany's merchant fleet comprises 1,800 ships (259 under the German flag and 622 under other EU flags).

- When comparing the economies of Germany and Poland, the Polish economy is about five times smaller than the German one due to historical factors, including demographic and economic potential and the post-WWII Marshall Plan, which Poland did not benefit from. However, the disparity in the size of merchant fleets is 21-fold, and in fleets under national flags, 18-fold. Such a significant difference is no longer justified by any objective circumstances - comments Captain Hatalski.

The absence of a national merchant fleet, particularly one under the Polish flag, affects Poland's position in international maritime organizations. This is evident in Poland's unsuccessful bid for a seat on the IMO Council in 2021, which represents a significant voice in shaping maritime policy and budgets. The lack of a national merchant fleet was one of the reasons Poland did not secure enough votes to join the Council.

Similarly, Poland's weak position in the maritime sector is reflected in the 2018 report "The Leading Maritime Nations of the World" by DNV GL and Menon Economics. This report lists the top 30 maritime economies globally, and Poland did not make the list.

Which administrative decisions and legal changes have shaped the current state of the Polish flag?

- The unfavorable state of the Polish flag is primarily due to the lack of decisions and changes rather than specific actions. Since the political transformation in the early 1990s, Poland has had a market economy, but flag state regulations remain rooted in the era of a centrally planned economy. The absence of modern flag state regulations adapted to the requirements of the international shipping market makes operating under the Polish flag economically unfeasible - adds Captain Hatalski.

Why do shipowners opt out of registering ships under the Polish flag?

The main reasons include:

- High non-wage labor costs due to the Polish maritime insurance system not aligning with international maritime labor market requirements.

- Lack of maritime mortgage regulations in the Maritime Code to facilitate obtaining loans from Polish banks, thereby limiting credit options for shipowners.

- Imbalance in the Maritime Labor Act between crew cost burdens and labor standards under the MLC convention.

- A 10-year mandatory period for opting into the tonnage tax system.

- Upfront registration fees paid in full instead of in annual installments.

- The requirement for all ship documents to be presented in Polish during registration.

What challenges does the Polish ship registration system pose for shipowners?

- The language of international shipping is English, and all ship documents and certificates are prepared in English, regardless of the ship's nationality. The Polish registration system requires documents to be submitted in Polish, creating unnecessary translation costs for foreign shipowners. Moreover, Polish ship registration regulations are complex, often requiring ships to be taken out of operation for several days due to bureaucratic delays, resulting in financial losses - explains Captain Hatalski.

What changes to the tonnage tax could make the Polish flag more competitive internationally?

- The tonnage tax is an optional tax replacing income tax. In the Polish tax system, the minimum period for opting into the tonnage tax is 10 years, during which shipowners cannot switch back to income tax. This period is too long for shipowners to make rational decisions about which tax system is more beneficial, as financial results cannot be reliably predicted over such a long timeframe. Reducing this period to 1-2 years could increase the competitiveness of the Polish register and flag - adds the Daily Mare expert.

Tadeusz Hatalski notes that the tonnage tax provides the benefit of decoupling the amount of tax from the financial performance of a shipping company. Instead, the tax is based on the tonnage of the ships operated rather than their financial results. Linking the tax to tonnage ensures stability for shipowners in a maritime market where economic fluctuations are a significant factor. Generally, the solutions adopted in Poland's tonnage tax system—except for the requirement of a 10-year commitment period—align with international standards.

Does the current tax model for shipping in Poland meet the needs of shipowners and support the development of a fleet under the Polish flag?

- The tax model, which includes the tonnage tax and personal income tax exemptions for sailors (with the 183-day clause), does meet shipowners' needs. However, the tonnage tax and the exemption for sailors (after spending 183 days on board) are insufficient mechanisms to encourage shipowners to register their vessels in the Polish ship register and operate under the Polish flag - comments Tadeusz Hatalski.

How do uncompetitive tax conditions limit the number of ships registered in Poland?

- Uncompetitive tax conditions significantly limit the number of ships registered in Poland. However, favorable tax conditions alone are insufficient to increase the number of vessels under the Polish flag. Comprehensive changes are necessary, including revising the social security system for sailors to reduce non-wage labor costs, amending maritime labor laws to streamline crew staffing and working time calculations, updating maritime law regulations regarding ship mortgages to facilitate financing, simplifying registration regulations, introducing an electronic ship register, and providing support for shipowners. Without these comprehensive changes, the Polish ship register and the Polish flag will remain unattractive to both Polish and foreign shipowners - adds Capt. Tadeusz Hatalski.

What contributes to the high costs of running shipping operations in Poland?

Financial costs:

- High social security contributions.

- High employment costs.

- Upfront registration fees.

- The need to translate documents into Polish.

Non-financial costs:

- Lack of credit facilitation.

- Absence of an electronic register.

- Time-consuming document translation.

- Bureaucratic hurdles, such as inspections by the State Labor Inspectorate (labor and working conditions inspections should fall under the Maritime Office).

What legislative changes in the taxation of shipping could increase interest in the Polish flag?

- A shipowner who opts for the tonnage tax system in Poland must commit to using it for 10 years. Reducing this period to 1–2 years could increase interest in the Polish flag - argues Tadeusz Hatalski.

How well does the current administrative infrastructure support shipowners, and where are the biggest gaps?

- The only support provided by the administration is the tonnage tax introduced in 2006 (albeit flawed due to the 10-year commitment clause) and the personal income tax exemption for sailors under the 183-day rule. This exemption, which has been part of British tax legislation for many years, is justified because sailors do not use state-funded infrastructure while on board - notes the expert from Gazeta Morska.

Could simplifying procedures related to the tonnage tax attract more ships under the Polish flag?

- Yes, it could. However, while necessary, it is not sufficient on its own. Attracting more ships under the Polish flag requires additional incentives and simplifications - comments Tadeusz Hatalski.

Poland could adopt mechanisms similar to those in countries like Malta or Cyprus, including favorable tax regulations that reduce costs associated with purchasing and operating ships. For instance, the tonnage tax could have a one-year commitment period, after which shipowners could renew or change their tax status. This approach offers flexibility and greater freedom in business decision-making.

Furthermore, registration procedures should be fast, flexible, and straightforward. Shipowners should be able to register and re-register their vessels easily without interrupting operations and regardless of the owner’s capital nationality. Gazeta Morska's expert also highlights the importance of favorable insurance and credit conditions, simplified administrative procedures for ship management, labor laws that balance shipowners' financial capabilities with compliance with the Maritime Labour Convention (MLC), and attractive programs for training sailors. Additional measures could include tax incentives for companies providing maritime-related services (e.g., fleet management, marine insurance, consulting), which would attract international businesses in the sector, as well as government support programs for the maritime industry, including financial assistance, training, and investment programs tailored to shipowners’ needs.

How could improving the profitability of shipping operations in Poland increase the fleet under the Polish flag?

- Enhancing the profitability of shipping in Poland—through favorable tax regulations, investments in infrastructure, reduced social security costs for sailors, and other economic incentives for shipping entrepreneurs—would encourage shipowners (both Polish and foreign, as many foreign owners have branches in Poland due to the employment of Polish sailors and management of crew and technical operations) to register their new vessels in the Polish ship register under the Polish flag. It could also lead to the re-registration of existing vessels. This would increase the fleet under the Polish flag without state financial outlays, ultimately contributing to the growth of the entire Polish maritime economy - says Tadeusz Hatalski.

How can the state support shipowners in increasing the competitiveness of the Polish flag on the international stage?

This can be achieved through intensive cooperation with EU and global maritime organizations, actively engaging in international agreements and initiatives promoting the merchant fleet under the Polish flag, and investing in the development of Polish maritime education to enhance its international standing. International campaigns could highlight the large workforce of Polish seafarers (approximately 50,000), who are highly regarded on the global market due to their professionalism, skills, and experience. A highly qualified crew reduces the risks associated with improper vessel operations and enhances maritime safety.

How do EU regulations and geopolitical factors influence the attractiveness of operating under the Polish flag?

- The European Union promotes the development of maritime transport under national and EU flags. To level the playing field for EU shipowners operating under EU flags against those under "flags of convenience," the EU published the Community Guidelines on State Aid to Maritime Transport in 2004. These guidelines allow (and even recommend) reducing both taxes and social insurance contributions to virtually zero. This means that companies registering ships under the Polish flag can enjoy the same rights as shipping companies from other EU member states. Unfortunately, no Polish government has fully implemented the 2004 Community Guidelines - notes Captain Tadeusz Hatalski.

The role of a National Merchant Fleet in safeguarding Poland's Strategic Maritime interests

Economy and Finance

The lack of a merchant fleet under the national flag results in tangible losses for the state's economy and public finances. The revenue from flag registration fees, tonnage tax, inspection fees, and other formalities goes to the flag state's budget rather than Poland's. According to estimates by Professor Witold Modzelewski, the loss to Poland's public finances due to the absence of a fleet under the Polish flag amounts to approximately 10 billion PLN annually.

Security of Strategic Supply Chains

Since the war in Ukraine, essential energy resources like coal, oil, and gas have been delivered to Poland by sea using foreign-flagged ships. This means that in case of external threats, Poland does not have effective administrative or legal control over these supply chains. In a crisis, foreign ships cannot be commandeered for state purposes, leaving only commercial control, which is insufficient during wartime. War clauses in charter agreements allow shipowners to abandon contracts if ports are in war-risk zones. Polish ports like Gdańsk, Gdynia, Szczecin, and Świnoujście are located on the Baltic Sea, which has become a high-risk area since the Russian aggression in Ukraine. Simply put, if missiles fly over the Baltic, Poland could be left without coal, oil, or gas.

Social Consequences

A 2019 European Court of Justice ruling requires social insurance contributions for seafarers (employed by EU shipowners under foreign flags) to be paid in their country of residence. Poland’s lack of a modern, internationally competitive social insurance system for seafarers has led to declining interest among EU shipowners in employing Polish seafarers, gradually eliminating them from the market. In the long term, this will negatively affect Polish maritime education, as a lack of employment opportunities for graduates will result in fewer candidates for maritime schools.

How do registration costs under the Polish flag compare to those of leading countries?

In Poland, registration fees for large vessels in the Polish Ship Register range from 40,000 PLN to 200,000 PLN, depending on the ship’s tonnage and type. These fees are payable upfront at the time of registration. By contrast, Malta charges €500 to €1,500 as a base registration fee, depending on the ship's size, with annual renewal fees ranging from €300 to €2,000.

While the total cost over the ship's lifetime is comparable, Malta's staggered annual fees are far more attractive for shipowners because:

- Payments are spread over the ship's amortization period (approximately 20 years).

- If the ship changes its flag, any unused portion of an upfront registration fee in Poland is non-refundable, whereas Malta’s annual fees minimize such financial losses.

Could digitizing administrative processes improve the attractiveness of the Polish flag?

The introduction of an electronic ship register could simplify registration, update processes more efficiently, and reduce costs. Key benefits include:

- Faster processing of registration and certification.

- Reduced downtime for ships awaiting documentation.

- Lower operational costs due to decreased reliance on paper-based bureaucracy.

- Integration with international systems for better data exchange.

Digitization would not only streamline operations but also improve Poland's image as a modern, innovative maritime nation, attracting shipowners seeking efficient fleet management solutions.

How can maritime training influence the growth of the Polish flag?

- Poland’s maritime education system is globally recognized, but the lack of a national merchant fleet under the Polish flag limits job opportunities for Polish seafarers. Following the 2019 EU ruling, high social insurance costs further disadvantage Polish seafarers on the international job market. A shrinking maritime workforce could undermine the viability of maritime education institutions in Poland - warns Captain Hatalski.

Strategic steps to enhance the prestige of the Polish Flag:

- Amend the tonnage tax law to establish shorter validity periods (1-2 years).

- Reduce labor costs by reforming the social insurance system for seafarers.

- Update the Maritime Code to facilitate easier access to credit for shipowners.

- Simplify ship registration procedures.

- Replace upfront registration fees with annual payments.

- Introduce an electronic ship register.

- Allow registration documents to be submitted in English.

- Transfer labor inspections aboard ships to Flag State Control authorities.

The Polish Flag as a matter of state interest

The lack of a national merchant fleet is not just an economic issue but a strategic failure of a state that has turned its back on the sea. Poland, with access to the Baltic Sea, has failed to leverage its potential for both economic and strategic benefits. Each successive government’s neglect of the maritime sector exemplifies shortsightedness and disregard for national interests.

A strong Polish flag is more than a symbol—it is a matter of sovereignty and national security. Countries with robust merchant fleets recognize the strategic importance of ships flying their flags as instruments of influence and prestige on the global stage. Poland, with its centuries-old maritime tradition, must not settle for being a nation of "cheap labor" for foreign shipowners.

Poland must end its "maritime amnesia" and implement a strategy that restores its maritime glory. Tax reliefs, streamlined procedures, and robust support for the maritime sector should be priorities. Without this, Poland risks being a country with a sea that holds no significance. Only bold vision and decisive action can reclaim Poland’s rightful place on the global maritime map.

The sea is Poland's raison d'état and must not be neglected further.

Kamil Kusier

redaktor naczelny

comments

Add the first comment

see also

Swedish ports record lowest ship calls in 18 years. Implications for the maritime sector

February in Szczecin’s shiprepair sector. Ice, overhauls and North Sea expansion

Advanced ROV trials conducted at CTO to validate subsea technologies for offshore applications

Stadt Naval to deliver electric propulsion system for Polish rescue vessel Ratownik

Gdańsk port’s Basen Górniczy to gain modern port infrastructure

First month of Jantar Unity operations. Polsca ferry paves the way for Batory program units

Baltic Power completes installation of all 78 offshore wind farm foundations

Hapag-Lloyd to acquire ZIM for $4.2bn: strategic consolidation in the container shipping market

Baltica 2 cable corridor taking shape: 150 km of inter-array routes completed in the Baltic Sea

PGE Baltica opens 2026 procurement pipeline to the market. Supplier webinar on 26 February

ADVERTISEMENT

ADVERTISEMENT